The main tax authority in Sri Lanka is the Inland Revenue Department (IRD), which guarantees equitable revenue collection, encourages voluntary compliance, and supports national development projects by means of funding. Whether you are a corporate entity, small business owner, or individual taxpayer, successful handling of your tax liabilities depends on knowing how the IRD runs.

The Inland Revenue Department (IRD)

Direct tax assessments, collection, and enforcement fall to the IRD; these include

- Income Tax

- Value Added Tax (VAT)

- Pay-As-You-Earn (PAYE) Tax

- Economic Service Charge (ESC)

Through its operations, the IRD funds critical services, infrastructure projects, and national welfare programs.

Quick Factsheet: Inland Revenue Department Sri Lanka

Download the free Tax Basics 2025 Factsheet (PDF) with current rates, services, and contact information.

Contact Details of IRD Sri Lanka

| Head Office: | Inland Revenue Department, Sri Lanka, Chittampalam A. Gardiner Mawatha, Colombo 02. |

| Phone Numbers: | 011 – 213 5135 |

| Fax: | 011 – 233 7777 |

| Call Centre | 1944 |

| Email: | commissioner@ird.gov.lk |

| Website: | www.ird.gov.lk |

| Important Links | |

| Income Tax | Click Here |

| Forms | Click Here |

| Registrations and Guidelines | Click Here |

| Tax Chart | Click Here |

Services Provided by IRD Sri Lanka

- Income Tax Registration and Processing

- VAT Registration and Management

- PAYE Tax Handling

- Issuance of Taxpayer Identification Numbers (TIN)

- Management of Tax Appeals

- Taxpayer Education Initiatives

- Tax Refund Processing

Explore the IRD E-Services Platform

The IRD’s E-Services portal provides the following features:

- Register for TINs online

- File tax returns

- Make secure online payments

- Request clearance certificates

- Update your taxpayer information

TIN Registration Guide

Free Download:

TIN Registration Checklist for Sri Lanka (PDF)

How to Register:

- Go to IRD official website and then click E-Services.

- Click “Access to e-Services.”

- Click on Taxpayer Registration.

- Choose Registration type

- Provide documents like NIC and Business Registration.

- Receive your TIN within 3–5 working days if documents are complete.

Important: You cannot open a business bank account without a TIN

Tax Chart – 2025 Overview

| Tax Type | Rate |

|---|---|

| Income Tax (Individuals) | 6% to 36% (Progressive) |

| Income Tax (Companies) | 30% (varies for SMEs/exporters) |

| VAT | 15% |

| PAYE | As per individual tax rates |

| Economic Service Charge | 0.5% (turnover-based) |

Note: Always refer to IRD official updates for the latest rates and regulations!

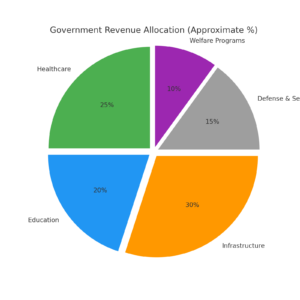

Where Your Tax Money Goes

How to avoid the 10% withholding tax levied on bank interest

This is a problem that many people have these days…. It seems there are significant queues at banks and the inland revenue these days, isn’t that correct? … Some people go to banks without knowing the correct procedure, stand in line, and just go home.

So this is the correct way to exempt this withholding tax.

Remember that withholding tax will not be levied on your interest if:

1. Your total annual income (subject to tax) is less than Rs. 1,800,000

2. You are a Sri Lankan citizen (resident)

3. You provide a tax declaration to every bank and financial institution where you have deposits That’s it.

- So if your annual income is less than Rs. 1.8 million, you have to do this,

1. Obtain a TIN Certificate

This is the income tax in your area You can also go to the regional office and fill out a form (it is not possible to get it on the same day)

Otherwise, the easiest way is to use the link below to register your TIN online

- You can register for TIN the way we discribe above.

So, register in one of these two ways and get the TIN Registration certificate (see the attachment for a copy)

2. Download the tax declaration form online or get it from your bank or financial institution and fill it (see the attachment for how to fill it)

(Remember that you can register in several banks or banks.) If you maintain accounts in multiple branches, you will need to fill out separate tax declaration forms.

3. Take the completed tax declaration, TIN certificate, and identity card to your relevant bank branch as soon as possible.

(If withholding tax is debited before payment, it cannot be easily recovered.)

4. Take an acknowledgement from the relevant bank stating that the tax declaration has been accepted….

That’s it.

Why Paying Taxes Matters

Your taxes contribute to:

- National healthcare services

- Free education for all citizens

- Road and transport infrastructure

- Social safety nets

- Economic growth initiatives

FAQs About Inland Revenue Department Sri Lanka

| Question | Answer |

|---|---|

| Who must register with IRD? | Any individual, partnership, or company earning taxable income. |

| How can I update my details? | Via IRD E-Services or by submitting a written update request. |

| Can I pay taxes with a credit card? | Yes, through the IRD E-Services online gateway. |

| How long to get a TIN? | Typically 3–5 business days if documents are correct. |

| What if I disagree with a tax assessment? | File an appeal within 30 days with the Commissioner General. |

Final Thoughts

The Inland Revenue Department of Sri Lanka continues to modernize and simplify tax compliance. By understanding your obligations, using e-services smartly, and staying informed, you help power Sri Lanka’s future.

CTA: Start Your TIN Registration Now!